Table 3 CPF Contribution Rate Table from 1 January 2022 for Singapore Permanent Residents SPR during 2nd year of SPR status under Graduated contribution rates GG Employees Age Years Employees total wages for the calendar month Total CPF contributions Employers Employees share Employees share of CPF contributions 55 below. Assuming the employee joined service on 1st April 2021 contributions start for the financial year 2021 2022 from April.

Download Kwsp Rate 2020 Table Background Kwspblogs

The table for 2021 employee and employer EPF contribution rate.

. Employees age years Contribution rates from 1 January 2022. Stage 1 Below 60 years old Stage 2 Age 60 and above 1. Fund contribution rate from 833 to 10.

SUMBER epf contribution table pdf. The present EPF interest rate is 865 and calculation of interest relies on the salary of the employee and on the share of employer contribution to PF. Monthly salary greater than RM5000.

Contribution Of March 2017how epf employees provident fund interest is calculated october 22nd 2016 - do you know how your employees provident contribution will earn interest rate how the interest will be calculated on your as well as your employer contribution let us discuss this. The above reduction is not applicable to the following. Monthly wages 750 By employer.

Employee contributes 11 of his monthly salary. The following table shows the monthly contribution percentage. Can an employee opt out from the Schemes under EPF Act.

The rate of monthly contributions specified in this Part shall apply to the following. The government understands the challenges faced by the people due to prolonged lockdowns and to increase cash in hand EPF will extend the minimum contribution rate from 11 to 9 until June 2022. To all establishments covered under EPF Mp Act 1952 for wage months May 2020 June 2020 and July 2020.

Calculate monthly tax deduction 2022 for Malaysia Tax Residents. Employees aged 60 and above. Employers are required to remit EPF contributions based on this schedule.

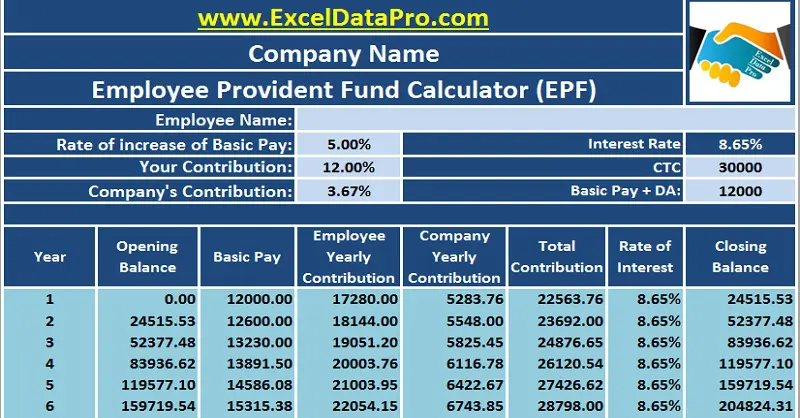

If you are interested to know the calculation of the EPF contribution formula you have came to the right place. From RM198001 to 200000. Employer Contribution Basic Salary DA X 367 X 12 months.

9 of their monthly salary. Contribution By Employer Only. Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022.

After the budget-2021 the EPF contribution rate is reduced from 11 to 9 February 2021 to January 2022 for employees under 60 years of age. Monthly Contribution Rate Third Schedule The latest contribution rate for employees and employers effective January 2019 salarywage can be referred in theThird Schedule EPF Act 1991. Employee contribution Basic Pay DA X 12 X 12 months.

Employee contributes 9 of their monthly salary. EMPLOYEES PROVIDENT FUND ACT 1991 THIRD SCHEDULE Sections 43 and 44A RATE OF MONTHLY CONTRIBUTIONS PART A 1. The following table summarises the current contribution rates for Singaporeans and SPRs from third year and onwards across the different age groups.

AMOUNT OF WAGES RATE OF CONTRIBUTION FOR THE MONTH FOR THE MONTH By the By the Total Employer Employee Contribution RM RM RM RM RM. Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000. The details of the same are as follows.

22091997 onwards 10 Enhanced rate 12 a Establishment paying contribution 833 to 10 b Establishment paying contribution 10 to 12. From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme. Employer contributes 12 of the employees salary.

Employer or companys contribution to EPF is 367 according to the EPF and MP Act. Employers contribution towards Employees Deposit-linked Insurance Scheme is 050 and the administrative charges are 050. What are the CPF contribution rates.

When calculating interest the interest applicable per month is 81012 0675. The FY 2021-22 EPF interest rates are as per the date March 12 2022 EPF Contribution Rate FY 2021-22. For the months where the wages exceed RM2000000 the contribution by the employee shall be calculated at the rate of 11 of the amount of wages for the month and the contribution by.

Wages up to RM30. Total EPF Contribution for April 2350. For Non-Malaysians registered as members from 1 August 1998 section B of EPF Contribution Table.

EPF Contribution Rates for Employees and Employers. Since 2020 the default. PF contribution rate is the significant contribution from employee income.

When wages exceed RM30 but not RM50. In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia. Employer contributes an amount equivalent to 12 of the employees salary.

By using the fill handle function of excel copy the formula till the end. The contributions made by employer and employee towards the EPF account is the same. According to the EPF contribution table.

However if the employee is willing to pay contributions at 11 rate heshe should fill the Borang KWSP 17A Khas 2021. Central and State Public Sector enterprises or any other establishment owned or controlled by or. Kami akan berikan beberapa contoh pengiraan potongan gaji untuk caruman kwsp berdasar rujukan epf contribution table 2022 melibatkan contoh pendapatan RM1000 RM1200 RM1500 RM2000 RM2500 RM3000 RM4000 RM5000 dan RM6000.

With this 172 categories of industriesestablishments out of 177 categories notified were to pay Provident Fund contribution 10 wef. An employee can choose to pay a higher rate if the employer is not under any objection to pay higher rates.

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

Epf Account Statement Passbook Broadcast Mobile App

Savings Investment Tips 10 Points On Public Provident Fund Ppf Investment What Every Indian Investment Tips Public Provident Fund Savings And Investment

How Epf Employees Provident Fund Interest Is Calculated

Bispoint Group Of Accountants Who Should Contribute Pcb Epf Socso Eis What Is The Rate Of Contribution How To Calculate Pcb Http Calcpcb Hasil Gov My Index Php Lang Eng Socso Contribution Table Https Www Perkeso Gov My Index Php

Epf Cut In Employee Contribution Means Take Home Is High But Will Increase Tds Liability Here S All You Need To Know Business News Firstpost

60 Million Epf Subscribers To Get 8 5 Interest Rate In Fy21 Business Standard News

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Epf Change Of Contribution Table Ideal Count Solution Facebook

Epf Contribution Rates 1952 2009 Download Table

Would Multimillionaire Epf Savers Help Poorer Members The Edge Markets

How To Calculate Provident Fund Online Calculator Government Employment

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Reduction In Epf Contribution Could Pose As A Risk In The Long Run Business Standard News

Mandatory Online Payment Of Epf Notification Simple Tax India

32 Kwsp Contribution Rate 2020 For Age 60 Png Kwspblogs

Sheen Diminished For Vpf But Not Lost Here S How Should You Invest Business Standard News

32 Kwsp Contribution Rate 2020 For Age 60 Png Kwspblogs

Sage Ubs Software Ubs Update Payroll Epf Statutory Contribution Rate Setup Effective On August 2013

- maksud pdpc abad 21

- cara mengisi nama first name dan last name

- resepi cheese tart sukatan cawan

- nota pengetahuan am malaysia 2020

- kad pendaftaran cidb

- kiraan tarikh bersalin

- drama cinta kau dan aku

- gambar pemandangan bunga sakura biru terindah

- hijau daun site youtube.com

- rambut baru maia estianty

- undefined

- epf contribution rate table

- logo biru gelap bulat png

- jenama tayar kereta

- resepi ikan rebus air asam

- contoh pemakaian kasut hitam

- resepi dendeng daging

- maybank customer service debit card

- contoh quotation kereta sewa

- maybank loan customer service